Every Fed or BoE rate cut is accompanied by headlines predicting a market reaction. Traders refresh charts, expecting a sharp move in GBP/USD, but decades of data tell a different story. Analysis shows that, on the day of the announcement, the currency barely budges. In fact, most of the action happens before the policymakers even speak.

1. Fetching the Data

To understand whether rate cuts are genuinely impactful, 25 years of UK and US policy rates and daily GBP/USD prices were pulled. This broad dataset allows for tracking the FX response not just on announcement days, but also around them, where positioning and expectations are actually built.

2. Processing Rates and FX Data

Each rate change is identified and classified as a hike or a cut. By joining this with FX returns, it is possible to check whether GBP/USD actually moves on the announcement day or if the market has already priced it in.

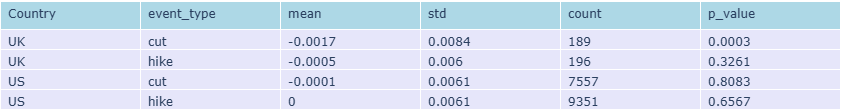

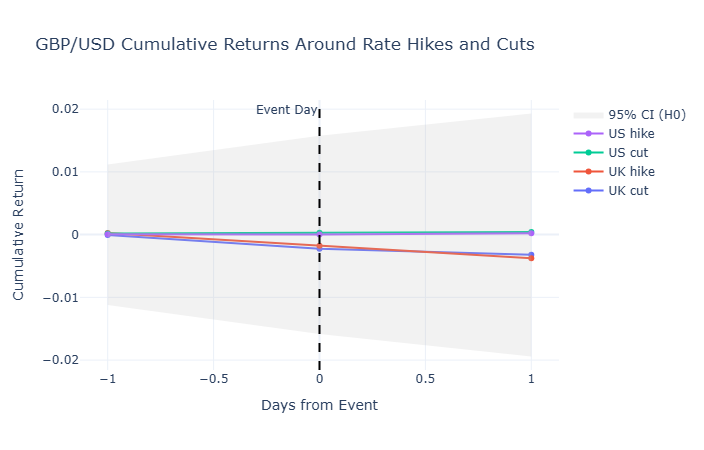

3. Event Study: One-Day FX Reaction

The focus is on the day of the rate decision, comparing it to the previous day. The results are striking: whether it’s a cut or a hike, GBP/USD rarely shows a meaningful move. In other words, if trading is done solely based on the headline, it is usually too late.

4. Visualizing the Limited Impact

A simple bar chart across decades shows the pattern: the FX market barely moves on the day of a rate cut. Most of the positioning occurs before the announcement, driven by market expectations rather than the actual headline. (See Figure 4.1)

5. What This Means for Traders

- Rate cuts on their own are not reliable tradeable signals-they are merely the confirmation of a market move that has often already occurred.

- The market has usually already priced in expectations, leaving minimal reaction on announcement day. The true signal lies in the data used to model these expectations.

- Trading based solely on the headline is often trading the last chapter of a story the market wrote in advance.

- The Edge comes from understanding market expectations, surprises, and positioning. This requires systematic, timely access to the granular economic and policy rate data provided by the API, not just the news announcement itself. Stop trading headlines, start trading data.

6. Conclusion

Data-driven analysis shows that GBP/USD does not react meaningfully to rate cuts in daily close data on the day of the announcement. This proves that the tradeable edge is not in the headline, but in the analysis of expectations, positioning, and relative rate differences-the exact kind of deep, granular data used in this study. Traders chasing headlines are often looking at the wrong metric. If you want to trade macro profitably, you must have access to the raw, reliable data streams used here to identify surprises, positioning shifts, and pre-announcement moves. Stop trading headlines, start trading data.

- Rob @ FXMacroData